Despite cost cutting measures lifting NZME’s operating profit four per cent, the media company reports a net loss of $165.2m after deciding to impair the value of intangible assets to account for a lower share price.

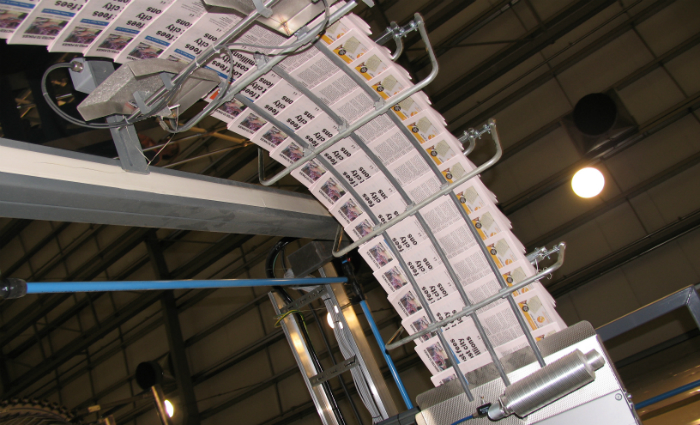

NZME owns the New Zealand Herald, other mastheads, radio stations and online tools. It says a challenging advertising market continued to affect print and digital advertising, together with declines in print circulation revenue.

NZME reported total operating revenue of $371.1m in the year to December 31, down four per cent compared to the previous corresponding period. However, the company has made progress with its digital subscription model and now has more than 46,000 NZ Herald Premium subscribers including more than 21,000 paid premium digital subscribers and 25,000 print subscribers who have activated their accounts. Digital subscriptions generated $1.7m revenue in the first eight months since launch.

Operating earnings before interest, tax, depreciation and amortisation fell seven per cent to $50.6m. Taking into account one less publishing week compared to the previous year, Ebitda decreased by five per cent and grew in the second half of 2019 compared to the equivalent period in 2018.

NZME adds it has impaired the carrying value of non-amortising intangible assets as at December 31 to account for a difference between the value of the company implied by its share price and the accounting value of equity. It adds that this is an accounting charge only with no change to cash flows and no impact on bank covenants.

Print revenue was $192.4m in 2019, including print advertising and circulation revenue, a decline of nine per cent from 2018.

NZME’s combined radio, digital and print audience of 3.2 million New Zealanders represents 80 per cent of the New Zealand population. NZME print readership is 1.3 million weekly print readers, with the New Zealand Herald weekly brand audience of 1.7 million people while NZME digital platforms reach 2.3 million digital users per month.

NZME has sought government support to buy rival media company Stuff. The Commerce Commission blocked the companies’ previous merger proposal, citing concern that the resulting entity would control too much of the print and website media.

NZME says it is actively engaged with the government regarding a proposed transaction that would involve the Stuff newsroom being transferred to an NZME subsidiary company in which a Kiwi Share would be held by government.

In a statement, NZME says, “The impact of big international players continued to put pressure on the New Zealand advertising market. In an already highly competitive local media market, there simply aren’t enough advertising dollars and not a large enough audience market to sustain New Zealand’s current industry structure. An acquisition of Stuff is aligned with NZME’s strategic priorities, our commitment to protecting the craft of journalism.”