|

The quality differences between the price points and technologies in digital print are shrinking fast. What is possible with almost entry level machines today surpasses what was possible with the generation of flagship machines only a few years ago. Manufacturers wishing to continue to distinguish their more expensive offerings have to stress instead the extra colours, the consistency or other effects that are possible on their machines, but not on lesser presses. |

But this is not always the case. Ricoh’s Pro C7100 and Pro C9100 have upset this apple cart. The first machine produces a respectable 70ppm, but with the option of white or clear toner in addition to the four process colours. Add in a lower fusing temperature to handle a greater range of substrates and also textured papers and a long sheet facility to extend printing to 692 mm in length, and it is not surprising that this machine has quickly become a standard in its class. The Pro C9100 can run at 130ppm, with long sheet capability and no loss of throughput on heavier papers. It is winning business from companies that have previously run the older generation of toner printers.

The Fuji-Xerox Versant models are praised for their colour quality at an entry level point, replacing the long lasting DC700 with a simply more impressive machine. The Color 1000 though is the press from Fuji-Xerox that led with a fifth colour, including metallic gold and silver effects. The company launched the iGen 5 last year with a spot colour option to extend the range of brand colours that the press could achieve.

Now, at drupa, Fuji-Xerox is to introduce a cut sheet inkjet press. The Brenva HD uses technology developed by Impika, the French company Xerox acquired two years ago. Quality is aimed at replacing preprint litho for sheetfed transactional printing rather than at usurping the top quality iGen, thus protecting demand for the toner press. It shares much of the engineering with the iGen and Nuvera machines developed in the US and could be tweaked to improve colour quality if needed.

Canon is also bringing out a cut sheet inkjet press, the i300. It is not a machine to fit in a corner, compared to Canon’s normal cut sheet toner machines. Early machines have been installed but a clear market has yet to be identified. Canon has no high-end toner product to protect, so has no need to control quality expectations.

However, Canon does have a new cut sheet machine to compete with the Ricoh machines. This is the C10000VP, a 100ppm four-colour toner press. The company has had experience of offering a fifth station for a clear toner option, but found that it added cost without becoming a fixture for many printers. The four colour machine delivers in terms of colour consistency, colour quality and improved substrate handling at the lighter end as well as the heavier end as is usually stressed. Creativity is delivered through the ability to cope with a wide range of substrates, including textured papers. It was only introduced at the end of last year so it remains early days, though first reports are promising delivering the quality and uptime that were perhaps lacking in earlier generations of digital press.

If printers need a white or clear toner, pairing the Pro C10000VP with an OKI five colour printer is a viable option. The OKI is a resilient engine which with the ability to cope with boards for ultra short run runs of packaging, greetings cards, social stationery or business cards, is a useful compliment to a digital print set up.

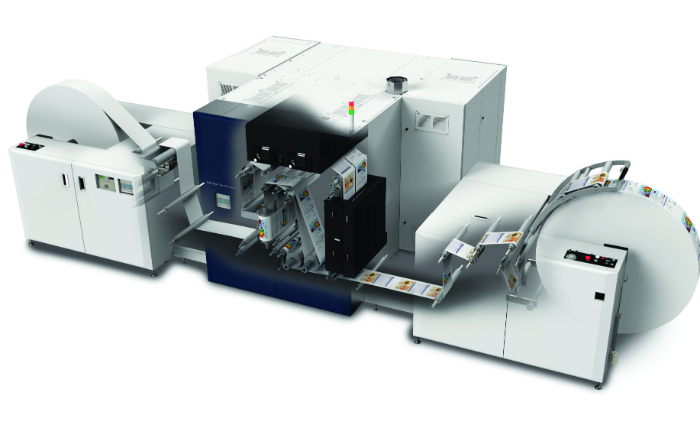

Konica Minolta has had its C1100 available for rather longer as the top of range toner press. It is supported by the C8000, now available with KM’s High Chroma toner. While not standard CMYK, it is directed at a market for photo products where super saturated colours are in demand, or perhaps for high impact promotional print. KM has now begun deliveries of its digital label press, built around a 70ppm toner engine and web transport system designed by Miyakoshi, more of whom later.

However, Konica Minolta has greater ambitions. Around four years after making its first trade show appearance, the KM-1 B2 inkjet press will this year enter commercial production. Unlike other inkjet machines, the KM-1 (also sold through Komori) uses UV inks. It includes a turning mechanism to print variable data on both sides of the sheet if required. UV curing eliminates the problems caused by water based inks on absorbent papers.

However, while undoubtedly able to deliver high quality print, there will be questions about productivity at the anticipated cost. Initial users include web to print companies and those looking at high value packaging applications. It will justify itself where jobs can be on and off faster than plate production, delivery to the press and the waste that can be created at start up.

Fujifilm has sold more than 70 of its Jetpress B2 sheetfed inkjet presses. It has been around for longer than the KM machine, having been previewed at drupa 2008. The Jetpress 720S is the latest iteration able to cope with cartons as well as calendars. The inline scanner to inspect for defects has been moved from the delivery to directly after the print heads so any drift in colour can be adjusted before it becomes noticeable and the impact from blocked nozzles can immediately be covered by using adjacent nozzles cutting back on wasted ink and sheets.

The B2 format is the new battleground for digital printing, attracting not just the attention of inkjet, but also of toner presses. The image width on most is restricted, so longer sheets are the way that Kodak for example chooses to deliver more pages. At drupa this extends to 1220 mm on the Nexpress 3900 ZX. It also gains additional colours, the ability to handle extra synthetic materials and the potential to juggle the print sequence. White could be in the first toner station for example rather than the fifth.

The Xeikon web press has long been able to produce a B2 sheet with a 508mm print width and limitless length. This is available on both commercial presses and those aimed at packaging. Xeikon, like other digital press suppliers, is planning for growth in the packaging area.

Xeikon has in the meantime focused on development of Trillium technology, a high viscosity liquid toner technology. The photo receptive drum is imaged using the same 1200dpi variable dot array used by most Xeikon machines. But instead of a dry toner adhering to the charge areas, the pigment particles are carried in a mineral oil carrier fluid. As this progresses through transfer rollers, the film is split each time until only the thinnest of films reaches the paper.

For Xeikon the technology is a rival to continuous inkjet, weighing in as less costly at higher ink coverages, running at a competitive 60m/minute, printing on coated papers and facing no drying problems. The first machines will ship to commercial customers midway through next year.

The same score technology is employed in a B2 sheetfed press being brought to market by RMGT as the DP7. It is a co development with Miyakoshi, which also provides the paper transport system for the Xeikon Trillium One. It retains the look of a conventional press with four print units before a tall fusing zone. Previewed at drupa 2012, it will be running at the show this year.

The same 2012 event was remarkable for the introduction of the Landa nanographiy process, an indirect inkjet technology that promised much, but which is poised to live up to those expectations. This year five machines will be on show, one in Komori colours, and four on Landa’s own stand, running at 6,500sph for a B1 sheet, and at 13,000sph when perfecting. A web version for flexible packaging at 40in wide will also be demonstrated. Again first deliveries come in the new year.

If Benny Landa acknowledges that development has taken longer than anticipated, HP Indigo has delivered on its promises. Its sheetfed presses remain unchallenged for providing the quality that others are measured against. They can print up to seven colours, with options for white and clear varnish effect toner (though a silver effect ink is no longer available). The 5000 series machines remain the entry level option with the 7000 range, now topped by the Indigo 7900, as the Heidelberg Speedmaster of digital printing.

There are versions for labels and packaging where the Indigo WS6800 is the most popular digital label press available. And there are larger format versions: the Indigo 10000 sheetfed B2 machines, the Indigo 20000 for flexible packaging and the Indigo 30000 for carton printing. The first has been available longest and more than 200 Indigo 10000 presses have shipped from the factory in Israel. Clever imposition schemes and slight adjustments to format can exploit the sheet format to deliver five true A4s from a sheet or more slightly smaller pages. An EPM feature uses CMY to reproduce all colours, dropping black to save a click and to increase throughput by 25 per cent.

The web version is beginning to pick up sales while the carton version is a little behind. It has a delivery including a Tresu coater to add the protective seal to a box.

At drupa there will be no fewer than six new models, the 5900, 7900, the WS8000, which combines two print units to double throughput of labels, improved Indigo 20000, the Indigo 12000 as a B2 sheetfed press using a new imaging head for greater precision of image placement, and the Indigo 50000 as the ultimate digital press to date.

This combines two Indigo 20000 presses with reel handing or inline finishing and turner bars to become a B1 web press for commercial print applications. HP Indigo is shy about the pricing, but not about the impressive performance. This is not a press for short run work.

|

Digital printing is rapidly becoming a concept where the printing device is in constant operation, where printers can exploit the lack of makeready to challenge the productivity of litho presses and their start-stop modus operandi. Few will quibble about quality produced by digital presses; all the printer has to do is find the machine that matches the business model the company has identified. T |

he quality differences between the price points and technologies in digital print are shrinking fast. What is possible with almost entry level machines today surpasses what was possible with the generation of flagship machines only a few years ago. Manufacturers wishing to continue to distinguish their more expensive offerings have to stress instead the extra colours, the consistency or other effects that are possible on their machines, but not on lesser presses.

But this is not always the case. Ricoh’s Pro C7100 and Pro C9100 have upset this apple cart. The first machine produces a respectable 70ppm, but with the option of white or clear toner in addition to the four process colours. Add in a lower fusing temperature to handle a greater range of substrates and also textured papers and a long sheet facility to extend printing to 692 mm in length, and it is not surprising that this machine has quickly become a standard in its class. The Pro C9100 can run at 130ppm, with long sheet capability and no loss of throughput on heavier papers. It is winning business from companies that have previously run the older generation of toner printers.

The Fuji-Xerox Versant models are praised for their colour quality at an entry level point, replacing the long lasting DC700 with a simply more impressive machine. The Color 1000 though is the press from Fuji-Xerox that led with a fifth colour, including metallic gold and silver effects. The company launched the iGen 5 last year with a spot colour option to extend the range of brand colours that the press could achieve.

Now, at drupa, Fuji-Xerox is to introduce a cut sheet inkjet press. The Brenva HD uses technology developed by Impika, the French company Xerox acquired two years ago. Quality is aimed at replacing preprint litho for sheetfed transactional printing rather than at usurping the top quality iGen, thus protecting demand for the toner press. It shares much of the engineering with the iGen and Nuvera machines developed in the US and could be tweaked to improve colour quality if needed.

Canon is also bringing out a cut sheet inkjet press, the i300. It is not a machine to fit in a corner, compared to Canon’s normal cut sheet toner machines. Early machines have been installed but a clear market has yet to be identified. Canon has no high-end toner product to protect, so has no need to control quality expectations.

However, Canon does have a new cut sheet machine to compete with the Ricoh machines. This is the C10000VP, a 100ppm four-colour toner press. The company has had experience of offering a fifth station for a clear toner option, but found that it added cost without becoming a fixture for many printers. The four colour machine delivers in terms of colour consistency, colour quality and improved substrate handling at the lighter end as well as the heavier end as is usually stressed. Creativity is delivered through the ability to cope with a wide range of substrates, including textured papers. It was only introduced at the end of last year so it remains early days, though first reports are promising delivering the quality and uptime that were perhaps lacking in earlier generations of digital press.

If printers need a white or clear toner, pairing the Pro C10000VP with an OKI five colour printer is a viable option. The OKI is a resilient engine which with the ability to cope with boards for ultra short run runs of packaging, greetings cards, social stationery or business cards, is a useful compliment to a digital print set up.

Konica Minolta has had its C1100 available for rather longer as the top of range toner press. It is supported by the C8000, now available with KM’s High Chroma toner. While not standard CMYK, it is directed at a market for photo products where super saturated colours are in demand, or perhaps for high impact promotional print. KM has now begun deliveries of its digital label press, built around a 70ppm toner engine and web transport system designed by Miyakoshi, more of whom later.

However, Konica Minolta has greater ambitions. Around four years after making its first trade show appearance, the KM-1 B2 inkjet press will this year enter commercial production. Unlike other inkjet machines, the KM-1 (also sold through Komori) uses UV inks. It includes a turning mechanism to print variable data on both sides of the sheet if required. UV curing eliminates the problems caused by water based inks on absorbent papers.

However, while undoubtedly able to deliver high quality print, there will be questions about productivity at the anticipated cost. Initial users include web to print companies and those looking at high value packaging applications. It will justify itself where jobs can be on and off faster than plate production, delivery to the press and the waste that can be created at start up.

Fujifilm has sold more than 70 of its Jetpress B2 sheetfed inkjet presses. It has been around for longer than the KM machine, having been previewed at drupa 2008. The Jetpress 720S is the latest iteration able to cope with cartons as well as calendars. The inline scanner to inspect for defects has been moved from the delivery to directly after the print heads so any drift in colour can be adjusted before it becomes noticeable and the impact from blocked nozzles can immediately be covered by using adjacent nozzles cutting back on wasted ink and sheets.

The B2 format is the new battleground for digital printing, attracting not just the attention of inkjet, but also of toner presses. The image width on most is restricted, so longer sheets are the way that Kodak for example chooses to deliver more pages. At drupa this extends to 1220 mm on the Nexpress 3900 ZX. It also gains additional colours, the ability to handle extra synthetic materials and the potential to juggle the print sequence. White could be in the first toner station for example rather than the fifth.

The Xeikon web press has long been able to produce a B2 sheet with a 508mm print width and limitless length. This is available on both commercial presses and those aimed at packaging. Xeikon, like other digital press suppliers, is planning for growth in the packaging area.

Xeikon has in the meantime focused on development of Trillium technology, a high viscosity liquid toner technology. The photo receptive drum is imaged using the same 1200dpi variable dot array used by most Xeikon machines. But instead of a dry toner adhering to the charge areas, the pigment particles are carried in a mineral oil carrier fluid. As this progresses through transfer rollers, the film is split each time until only the thinnest of films reaches the paper.

For Xeikon the technology is a rival to continuous inkjet, weighing in as less costly at higher ink coverages, running at a competitive 60m/minute, printing on coated papers and facing no drying problems. The first machines will ship to commercial customers midway through next year.

The same score technology is employed in a B2 sheetfed press being brought to market by RMGT as the DP7. It is a co development with Miyakoshi, which also provides the paper transport system for the Xeikon Trillium One. It retains the look of a conventional press with four print units before a tall fusing zone. Previewed at drupa 2012, it will be running at the show this year.

The same 2012 event was remarkable for the introduction of the Landa nanographiy process, an indirect inkjet technology that promised much, but which is poised to live up to those expectations. This year five machines will be on show, one in Komori colours, and four on Landa’s own stand, running at 6,500sph for a B1 sheet, and at 13,000sph when perfecting. A web version for flexible packaging at 40in wide will also be demonstrated. Again first deliveries come in the new year.

If Benny Landa acknowledges that development has taken longer than anticipated, HP Indigo has delivered on its promises. Its sheetfed presses remain unchallenged for providing the quality that others are measured against. They can print up to seven colours, with options for white and clear varnish effect toner (though a silver effect ink is no longer available). The 5000 series machines remain the entry level option with the 7000 range, now topped by the Indigo 7900, as the Heidelberg Speedmaster of digital printing.

There are versions for labels and packaging where the Indigo WS6800 is the most popular digital label press available. And there are larger format versions: the Indigo 10000 sheetfed B2 machines, the Indigo 20000 for flexible packaging and the Indigo 30000 for carton printing. The first has been available longest and more than 200 Indigo 10000 presses have shipped from the factory in Israel. Clever imposition schemes and slight adjustments to format can exploit the sheet format to deliver five true A4s from a sheet or more slightly smaller pages. An EPM feature uses CMY to reproduce all colours, dropping black to save a click and to increase throughput by 25 per cent.

The web version is beginning to pick up sales while the carton version is a little behind. It has a delivery including a Tresu coater to add the protective seal to a box.

At drupa there will be no fewer than six new models, the 5900, 7900, the WS8000, which combines two print units to double throughput of labels, improved Indigo 20000, the Indigo 12000 as a B2 sheetfed press using a new imaging head for greater precision of image placement, and the Indigo 50000 as the ultimate digital press to date.

This combines two Indigo 20000 presses with reel handing or inline finishing and turner bars to become a B1 web press for commercial print applications. HP Indigo is shy about the pricing, but not about the impressive performance. This is not a press for short run work.

Digital printing is rapidly becoming a concept where the printing device is in constant operation, where printers can exploit the lack of makeready to challenge the productivity of litho presses and their start-stop modus operandi. Few will quibble about quality produced by digital presses; all the printer has to do is find the machine that matches the business model the company has identified.