KBA reports order figures, revenue, and earnings, coming alongside a successful drupa, for the second quarter of 2016.

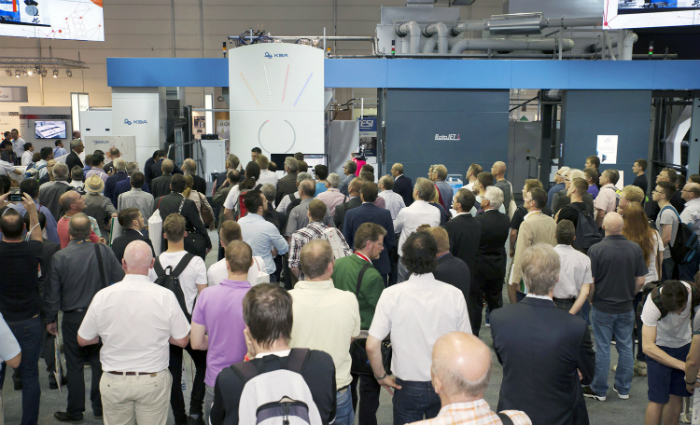

At €352.5m ($548.8m) group order intake from April to June rose 17.2 per cent year-on-year. Figures for this quarter contain around a third of orders placed at the trade show which KBA describes as in the triple-digit million euro range. The company believes the catch-up effect will ensure additional stimulus in the second half-year as it traditionally only books fully documented and financially secure orders.

After six months, the group order intake got to €618.8m, 1.9 per cent higher than last year. Revenue increased over the same period by 29.7 per cent and order backlog rose seven per cent to €639.8m. Claus Bolza-Schünemann, president and chief executive at KBZ, says, “This is a solid buffer for the second half-year and gives us ample security to raise our targets for 2016 despite existing economic and political turbulence. We now expect an EBT margin of around four per cent with group revenue between €1.1 and €1.2bn.”

The company also reports a rise of 30 per cent in revenue compared to 2015; solid capacity utilisation at KBA’s facilities; and cost savings from the restructuring programme completed at the start of the year, saying these had a positive impact on earnings after six months despite high trade show and development costs. EBIT improved to €20.7m compared to the prior-year loss of –€8.3m. A slightly negative interest result of –€2.9m led to a group pre-tax profit (EBT) of €17.8m. After deducting income tax expenses, group net profit came to €17.2m (2015: –€9.3m).

The increase in inventories for the sales volume anticipated in the second half of 2016 and the rise in receivables following higher deliveries strained the net inflow of funds. Nevertheless, compared to the prior year (2015: –€28.9m) cash flows from operating activities improved to –€10.6m thanks to the earnings. The free cash flow stood at –€14.4m, compared to –€25.2m twelve months ago. Funds at the end of June 2016 came to €168.7m.

Less bank loans, KBA’s net liquidity stood at €154.5m.

KBA says drupa brought in orders in the triple-digit million euro range for its largest segment, sheetfed. Around a third of these orders were already visible in the group’s figures for the second quarter and the other two thirds will be booked in the coming months. It says that at €290.8m, order intake with unchanged good margins was on track. However, given the weaker economy in some key markets it did not reach the prior year’s high figure of €368.1m. Revenue was up 22.1 per cent to €291.7m compared to the previous year. Order backlog at the end of June came to €281.9m.

At €66m order intake in the digital and web segment was similar to that of the prior year. Revenue rose by over 75 per cent to €64.5m with digital presses for the decor and corrugated markets making a key contribution. Order backlog remained solid at €71.8m. Although development expenses for the growing digital printing market impacted on earnings, the segment loss was reduced further to –€0.9m (2015: –€8.9m) thanks to a profit in the second quarter. KBA believes this segment will achieve its annual target of a profit.

The increase in demand in security, metal, coding, flexible packaging and direct glass decorating drove order intake in the Special segment up 47.7 per cent to €294m year-on-year. Revenue here rose by 37.7 per cent to €233.9m compared to the previous year. The increase in revenue and catch-up effect from a large security project led to a segment profit of €20.1m in the second quarter. This segment’s EBIT after six months grew to €20.3m (2015: €3.6m).

The group’s export level rose from 84.9 per cent in 2015 to 86.1 per cent. 28.4 per cent of deliveries went to other parts of Europe; 14.1 per cent to North America, 30.4 per cent to the region Asia and the Pacific and 13.2 per cent to Latin America and Africa.

KBA has 5201 employees were on the group payroll at the end of June 2016, 65 fewer than the previous year. Excluding apprentices, trainees, employees exempted from their duties and staff on phased retirement schemes the group workforce sank to 4719.

KBA sees unfavourable global economic conditions. Despite this, KBA management board to raise its revenue and earnings targets for 2016 based on the positive book-to-bill ratio with a rise of 30 per cent in group revenue in the first six months compared to 2015; high order backlog; a raft of promising customer projects; and the growing service business.

KBA says its sheetfed segment, with a footing in packaging printing, remains on track to reach its revenue and earnings targets for 2016. The management board targets a profit in its Digital and Web segment by the end of the financial year. In the Special segment, KBA anticipates clear growth with a significant earnings improvement in 2016. The security business almost doubled order intake compared to 2015. Incoming orders from the flexible packaging printing and hollow glass container decoration markets also rose by two digits.

With this in mind and given positive revenue and earnings in the first half-year, the KBA management board sees a rise in group revenue above its initial planning to between €1.1 and €1.2bn as well as an increase in the EBT margin to around per cent.