KBA says it has achieved a turnaround in earnings, reporting its third quarter order intake and sales.

After nine months, the group posted a net profit of €2.4m($3.9m). The company’s current interim report shows annual group revenue of over €1bn expected and a planned EBT margin of up to ttwo p er cent.

At the end of September, the group order intake of €859.6m was up 28.5 per cent and the order backlog of €597.3m was up 36.6 per cent year-on-year, although the economic climate for the engineering industry has cooled in China and other key threshold countries. The group’s largest segment, sheetfed offset, compensated for slower business with China with more orders from other regions, especially the USA and Japan.

Claus Bolza-Schünemann, president and chief executive at KBA, says, “The optimisation of our product spectrum and the organisation at our sites remain ongoing. Sustainable profitability in all business fields is our highest priority for 2016, also in order to reduce the influence of cyclical and market-driven special effects in security printing on profitability further.”

Compared to 2014, all business divisions posted a double-digit rise in the volume of new orders. In spite of some postponed deliveries, KBA increased its quarterly revenue. However, revenue for the full nine months fell 14.2 per cent on the prior-year figure and proportionally behind the annual target. KBA expects the especially high-revenue fourth quarter of 2015 to contribute more strongly to achieving its sales and earnings targets with greater earnings contributions and a higher margin product mix.

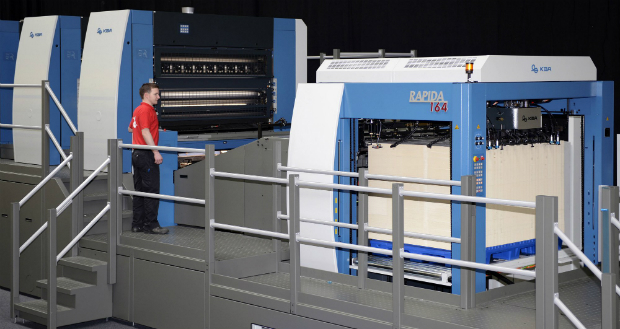

The Sheetfed Solutions segment exceeded the prior-year figure by 18.2 per cent thanks to an encouraging volume of orders mainly from packaging printers. Over the entire reporting period, order intake rose by 33.1 per cent year-on-year to €516.4m. KBA reports that a good level of capacity utilisation and progress with costs and prices led to an increase in segment result to plus €10.1m and adds that it expects this positive earnings trend to continue in the subsequent quarters.

KBA sees this application as part of its growth: direct decoration of premium glass packaging using screen and digital printing systems

The volume of new orders rose in the reorganised Digital & Web Solutions segment by 47.4 per cent compared to 2014. However, higher development costs for new digital printing markets hit earnings in the third quarter. The segment posted a loss of €12.2m for the full nine months. KBA expects a turnaround in the fourth quarter from higher revenues and a reduction in costs resulting from the restructuring and capacity adjustment.

Orders for security presses, which increased significantly compared to the previous year primarily drove order intake in the Special Solutions segment up 14.2 per cent. KBA anticipates a rise here in the fourth quarter.

At 85.4 per cent, KBA’s export level stayed on par with the previous year. Fewer web and special press installations led to a decline in the proportion of group sales attributable to other parts of Europe from 35.8 per cent in 2014 to 29.4 per cent. North America 10.1 per cent to 14.1 per cent and Asia and the Pacific rose from 24.2 per cent to 33.6 per cent. Latin America and Africa generated 8.3 per cent of group sales.

At the end of September 2015, KBA had 5,285 employees on its group payroll, 645 fewer than twelve months earlier. The company is training 384 apprentices. Excluding apprentices, employees exempted from their duties and staff on phased retirement schemes, the group workforce sank from 5,281 the previous year to 4,633.

The KBA management board has expressed confidence the group can achieve the targeted group revenue of over €1bn by the balance sheet date. It expects a significant increase in revenue and a sizeable earnings improvement over the next quarters at KBA-Digital & Web following the elimination of capacity underutilisation and a stronger focus on the growing digital printing market. It adds that good market opportunities in digital decor printing and the alliance with HP in digital corrugated printing provide the division with considerably brighter prospects.

It also expects revenue in the Special Solutions segment to increase in the fourth quarter, primarily driven by KBA-NotaSys and KBA-MetalPrint active in banknote printing and metal decorating. Revenue gains planned in almost all of the company’s business units by the balance sheet date will have a significantly positive effect on group earnings.

The management board will complete the core of its restructuring programme Fit@All at the end of 2015.