It looks like offset press giants Heidelberg and KBA have begun to shake off the residue of the devastating impact of the GFC, with latest figures for both companies showing a sustained improvement.

All offset press manufacturers suffered from a comnbination of the GFC and the increased effect of all things digital back in 2008. Orders collapsed, and most of the big five struggled as a result. Heidelberg had state intervention as its saviour; manroland went broke and split in two before a succesful sell-off; KBA downsized significantly; and, in Japan, Ryobi took over the Mitsubushi press manufacturing operation.

Web offset press sales now run at 10-15 per cent of the pre-GFC era, while sheetfed sales have significantly reduced, although by nowhere near as much.

Heidelberg’s latest figures show incoming orders for third quarter 16 percent up on previous year. Group sales match previous year’s level at €1.66bn despite, gative exchange-rate effects, and its operating result (EBITDA) improves once again to €105m.

Heidelberg says its digital transformation bearing fruit – with its subscription model attracting considerable interest, and with further growth in demand for innovative digital packaging and label presses.

Profitability rose further compared with the previous year’s figures. After three quarters, EBITDA excluding restructuring result climbed from €94m to €105m. As a result, the EBITDA margin after nine months was 6.3 percent after a figure of 5.6 percent in the previous year. EBIT excluding restructuring result totaled €54m (previous year: €43m).

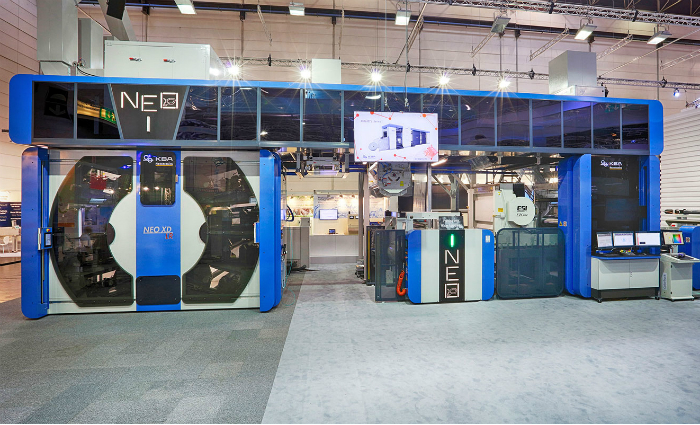

Meanwhile rival Koenig & Bauer fully achieved or exceeded its guidance for 2017. The printing press manufacturer’s consolidated figures show that with the increase in revenue, earnings and order intake achieved last year.

At €1.22bn KBA group revenue reached the target corridor of up to €1.25bn defined in its guidance. With revenue up 4.3 per cent over the previous year (€1.17bn), Koenig & Bauer achieved its mid-term organic revenue growth rate of around 4 per cent pa more than making up for the further decline of €25m in revenue from newspaper and commercial web presses.

The group’s new orders rose substantially by 10.1 per cent over 2016 (€1.15m) to €1.27m. With orders up 29.7 per cent over the previous year, the fourth quarter was particularly strong. The book-to-bill ratio came to 1.04, while order backlog stood at €606.2m, up 8.7 per cent on the previous year.

Its EBIT margin of 6.7 per cent exceeded guidance of around 6 per cent for 2017.