A report by industry researcher Smithers Pira says the industrial and functional printing applications doubled in the last five years, from $37.2bn to $76.9bn, and will continue to see strong further growth to an estimated value of $114.8bn in 2022.

It says that new digital printing systems will provide real opportunities for commercial printers to enter the market, which it says does not require a high skill set.

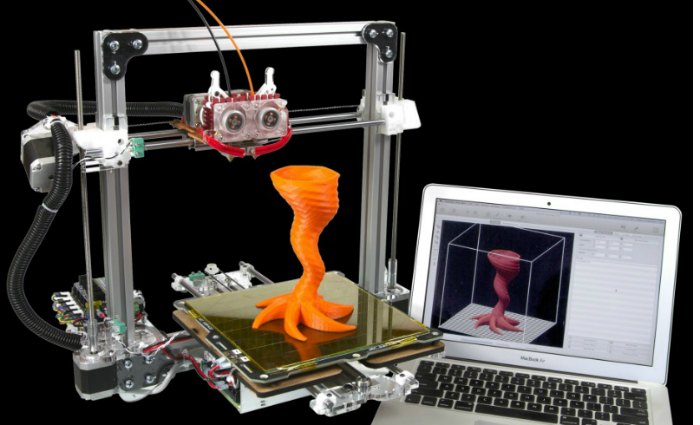

Applications included in its definition of industrial print include décor and laminates; ceramics; electronics, including displays and photovoltaics; glass; aerospace and automotive; biomedical; promotional and miscellaneous items; 3D printing; and inkjet printed textiles.

The report says that while some of this market is closed, with some large manufacturers developing proprietary methods as part of their manufacturing processes, the growth provides many opportunities for print companies to diversify, and for equipment manufacturers and ink providers to move into new markets.

Sean Smyth, author of the report says, “Suppliers have developed new equipment that widens the applications, with new inks, coatings and functional fluids providing new properties of flexibility, adhesion and durability, together with novel capabilities in electronics and biomedical to provide specific actions. While analogue printing methods – gravure, flexo, litho, screen, pad printing and foiling – are widely used, there is strong growth in digital methods, with new inkjet inks and fluids opening many new opportunities.

“These markets do not use paper or paperboard substrates, but rather plastic, film, glass, wood, metal, ceramics, textiles, laminates and composite materials are involved. In the case of 3D printing there are plastics and metals, with some composites.”

Asia, the largest region for industrial printing, plays home to large printing companies supplying electronics and environment materials, films and interior décor materials. It also has many giant electronic companies using printing as part of the manufacture of membrane switches, tags, circuitry, displays and photovoltaics.

The report also points to strong growth in industrialised markets for high value items and as improvements to many manufacturing processes, with new technologies under development in these regions such as inkjet textile bringing high-value; short-run textile printing closer to the end user; and 3D printing enabling changes to some manufacturing while potentially changing business models and whole supply chains through distributed 3D printing on-demand. Printing may form part of a wider manufacturing process or, in the case of 3D additive printing, the actual manufacturing.

However, the routes to market for printing appear complex and fragmented.

Established suppliers may be manufacturers, or part of a wider supply chain. Often these companies will show less concern about the efficiency of a printing process when it forms just one component of a manufacturing process.

When building a car that sells for $30,000, an instrument panel that costs $100 forms a significant part of the car, but not a critical part of the cost build-up since print on that $100 panel will have a value of only one or two dollars.

The demand for ever-increasing efficiency of printing technology does not play out in the same way – until print becomes a bottleneck or the end-use market demands change. Gravure, screen, pad printing and foiling remain perfectly adequate for many of the long-established applications in which they are used. In producing a beer stein or sheet of exterior architectural glass, the printing comprisers only a small component of the process and, often, the decoration will integrate into the manufacturing line. In a changeover, the print set-up generally works a lot simpler than the product change.

This print probably requires a lesser required skillset than in commercial print or packaging; manufacturers often outsource prepress production with screens, plates and cylinders bought in as required and reused over many years. The management of the industrial plant will concentrate on improving the methods of making the product rather than the intricacies of print technology. There also appears much activity in developing routes to market, for print suppliers and equipment manufacturers, and for associated consumables supply.

The report ‘The Future of Functional and Industrial Print to 2022’[http://www.smitherspira.com/industry-market-reports/printing/the-future-of-functional-and-industrial-print-(1) is available for purchase online.